SMART ENERGY MANAGEMENT

NHỮNG THỬ THÁCH KHẨN CẤP CỦA VIỆT NAM VÀ THẾ GIỚI

Local groups capitalise on M&A opportunities

Vietnam has witnessed a surging number of local groups acquiring assets from both domestic and foreign players, with the rise signalling a major change in the mergers and acquisitions game in the country.

At last week’s annual general meeting, Vietnam Dairy Products JSC’s (Vinamilk) chairwoman Mai Kieu Lien said the group will continue its mergers and acquisitions (M&A) to sustain its stable growth in the midst of the crisis. The company will explore opportunities in both local and foreign markets as well as consider such deals to venture into new segments. Last year Vinamilk announced that it had officially become the parent company of GTNFoods after finishing the purchase of 79.5 million GTN shares (an additional 31.83 per cent stake) to raise its holding to 75 per cent. After the transaction, Vinamilk owns 51 per cent in Moc Chau Milk, a subsidiary of GTNFoods.

Elsewhere, Masan Group has conducted several consecutive acquisitions in recent years such as those of Vinacafé, the Net washing powder brand, and Vinh Hao mineral water brand. Under the support of major players such as Masan, the products have accessed markets through the group’s distribution channels.

Masan Group general director Danny Le stated that 25 years ago the group focused only on the seasoning segment. “After that, we saw the potential in consumer goods so we decided to branch into the instant noodle and beverage segments,” Le stated. “Masan pursues M&A deals of potential brands to expand its product portfolio. Our acquisitions are aimed to expand our distribution network as well as build strong local brands in the domestic market.”

A strategic fit

The deals reflect the rise of local groups in M&A game, which used to be a playground for foreign players. Strategic investors from countries such as Japan, South Korea, Thailand, and Singapore are the most aggressive buyers in the Vietnamese market. However, more Vietnamese companies are becoming more proactive in conducting M&As, with the list of deep-pocketed Vietnamese buyers including Vingroup, Kido Group, Masan, REE Corporation, The PAN Group, and Truong Hai Auto Corporation.

According to Ong Tiong Hooi, partner of Transaction Services at PwC Vietnam, emerging from the pandemic, this could be the time for Vietnamese organisations to take actions that will position themselves for success. Local groups have the advantage of on-the-ground knowledge and understanding of the local business environment, which enables them to quickly assess cultural and strategic fit of deal opportunities that complement their respective business growth plans.

“Despite experiencing a decline in deals volume, there were positive statistics with Vietnam’s M&A scene being the least affected among the six major economies in Southeast Asia,” Hooi told VIR late last year. “So, it is not surprising that domestic private companies with surplus cash will look for the right deals to help future-proof their businesses.”

Hooi more recently cited a report from the Corporate Investment and Mergers & Acquisitions Center stating that local groups account for nearly a third of total M&A deals, an increase from around 12 per cent in 2018. It also notes that Vietnamese businesses are pushing outbound investment activities more actively, with one example being Vingroup’s increased investment in countries including France, Canada, and Singapore this year.

Seck Yee Chung, partner at Baker McKenzie said, “As Vietnamese companies grow in size, stature and experience, M&A increasingly becomes a compelling way to grow their business and operations, or to address a gap in their portfolio or ecosystem. This could mean diversifying into new sectors or geographies, scaling rapidly, accessing new assets such as location, technology, talent or customers, or integrating into and securing its supply chains.”

“As one of the fastest-growing economies in Southeast Asia, Vietnam has been and will continue to be an attractive market for investors,” he added. “While foreign companies will remain to be major players in the M&A market, Vietnamese companies are making their footprints in this space too. COVID-19 has created unexpected difficulties to the global economy, but at the same time, opportunities may arise from a crisis.”

In terms of the target companies and collaborators, recent years have witnessed major M&A deals where local companies acquired both foreign-owned and other Vietnamese companies. These include Masan Consumer’s acquisition of VinCommerce and VinEco in 2019, and Vinfast’s acquisition of GM Vietnam in 2018. Historically, there were major deals such as Sovico Group’s acquisition of Furama Resort Danang in 2005 and Thien Minh Group’s acquisition of Victoria hotels from EEM Victoria Hong Kong in 2011.

Seeking stable growth

It is clear that more local groups are stepping up their M&A efforts to restructure their portfolio and increase competitiveness during the pandemic. Given that foreign investors cannot travel to Vietnam due to border restrictions in place, financially sound local players can enjoy a home-run advantage to ramp up their dealmaking activities, thereby elevating the position of Vietnamese groups in the M&A landscape.

Nova Group is focusing on M&A to expand its land bank, ensuring stable growth in the next 7-10 years. The group uses such transactions as a flexible strategy for investment and divestment to meet profit expectations and deliver good value.

REE Corporation is also eager to capitalise on M&A in electricity, water, and real estate this year. To facilitate the goal, the group will not pay dividends for shareholders this year to secure capital to make deals quickly rather than borrowing bank loans.

Elsewhere, The PAN Group continues to complete its M&A plan with Bibica and Vietnam Fumigation Company. At the same time, the group is scouting potential target companies to acquire with a view to complete its value chains.

As more Vietnamese groups pursue M&As in the coming time, Hooi from PwC Vietnam pointed out that robust due diligence is now more crucial than ever for businesses to gain a complete picture of the benefits and risks associated with each deal. While it can be tempting to chase an acquisition simply because it becomes available, it is important to evaluate how that deal might affect other potential transactions that could be necessary in executing the company’s overall growth plans.

By Olivia Bui

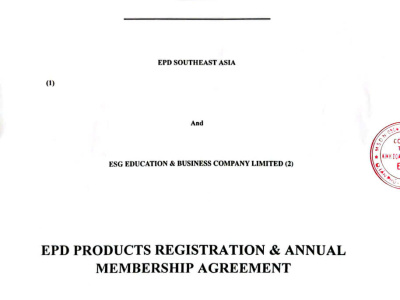

EIP Vietnam thực hiện mục tiêu tư vấn chuyển đổi KCN Sinh Thái và NetZero Carbon, Energy và phát triển bền vững ESG ở Việt Nam bằng cách kết nối với nhiều tổ chức môi trường quốc tế uy tín, những người khởi xướng toàn cầu về tính bền vững, hành động vì khí hậu, hệ sinh thái xanh và năng lượng tái tạo. EIP Vietnam thực hiện tư vấn theo khung EIP của UNIDO, Worldbank, GIZ.

![NGUYỄN ĐÌNH QUYỀN [VN]](https://kcnst.com/wp-content/uploads/NGUYEN-DINH-QUYEN-VN-400x300.png)